Japan Outlook – Further hikes on the cards in 2025, but 2026 will mark the end

- 04 December 2024 (5 min read)

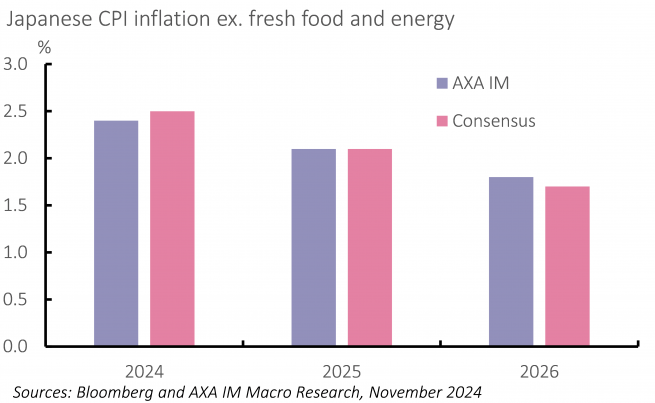

Japan appears to have closed the door on deflation in 2024, with a virtuous wage/price spiral appearing to take hold. Indeed, the 2024 Shunto wage negotiations resulted in a 3.6% increase in base pay and a 5.17% rise in total pay, well above the average of the previous 10 years – 0.9% and 2.6%, respectively. Businesses also showed they were willing to pass on higher costs. While the headline inflation rate bumped about throughout the year due to the removal and reimposition of energy subsidies, the underlying inflation rate – which excludes fresh food and energy – is on course to average 2.4% this year (Exhibit 11). Prices in the labour-intensive services basket also showed signs of picking up.

A similar result likely will emerge next year, with Rengo – the key union – setting its target for total pay at 5% for large firms and “over 6%” for small and medium businesses. While the slowdown in inflation across 2024 means the risks lay to the downside for this settlement, we see scope for a structural rise in wages over the coming years. Dwindling labour supply amid an ageing population should increase bargaining power, while rising inflation expectations among households and businesses should pave the way for larger pay rises in the coming years. We look for a rise in base pay of around 3% in 2025 and 2026. With wage gains staying elevated, growth above trend and the yen staying around the ¥150-mark, underlying inflation looks set to average 2.1% next year. More generally, though, estimates suggest that consistent 3% pay rises each year – feasible given labour supply constraints are unlikely to abate soon – are probably consistent with underlying inflation of just below 2%. Combined with expectations of an appreciating yen in 2026, this means CPI inflation excluding fresh food and energy will likely ease to a little below target at 1.8% in 2026.

Japan’s economy is on course to decline by 0.3% over 2024 as a whole. Factory shutdowns in the auto sector due to concerns over safety signoffs weighed heavily on Q1 growth and inventories and net trade knocked 0.2 percentage points (ppt) and 0.6ppt off quarterly growth in Q2 and Q3, respectively. After a weak start, household spending has started to ramp up, helped by a rebound in real incomes, while strong growth in corporate profits has supported an increase in capex.

Looking ahead, the new government’s ¥39tn fiscal package will underpin just around a 0.6% increase in government expenditure in 2025. The expected income tax threshold increase and minimum wage should support a further modest recovery in private consumption. Note, though, that growth in household spending will be limited by weak confidence; at least some of the real income increase will most likely be saved. A further increase in profits, meanwhile, as nominal GDP growth remains on an upward path, and the growing need to invest in technology to replace a declining workforce will keep investment ticking over. Yet, our expectation of a material slowdown in the US in 2026 would hit net trade, while higher borrowing costs would lead to a slowdown in private investment and consumption. We look for growth of 1.1% in 2025, before slowing to 0.9% in 2026.

With the virtuous wage/price spiral broadly embedded and growth slightly above trend in 2025, we expect the Bank of Japan (BoJ) to maintain its policy normalisation path, with 25 basis point hikes in December this year and September 2025, after Upper House elections in July. But we think the BoJ will be forced to halt policy normalisation there. With tariffs and reduced labour supply expected to lead to a material slowdown in the US in 2026 and the Federal Reserve beginning to ease policy again, pressure on the yen looks set to reverse, putting downward pressure on inflation in the medium term, while slowing growth will muddy the domestic picture. We think the BoJ will maintain its key policy rate at 0.75% throughout 2026.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.