AXA People & Planet Equity

Seeking to deliver positive, measurable impact and financial returns.

Strategy overview

What is listed impact equity investing?

AXA IM’s Listed Impact Equity Approach

Asset contribution

Identifying companies that can generate positive measurable impact

We asses companies using our Impact Assessment Framework, which focuses on how a company’s products and services contribute to achieving the targeted impact outcomes. We have developed this framework to align with the Global Impact Investing Network (GIIN’s) guidance for pursuing impact in listed equities.

We invest at least 70% of the portfolio in the most impactful companies. We won’t invest in companies that we assess as having a neutral or negative impact.

We only invest in companies that are providing solutions to our targeted outcomes, as we think that this has a more powerful impact than investing in companies that are improving their own footprint or complying with best practice. We believe that the positive impact made by solutions providers reaches beyond direct stakeholders and the locality of their operations to create a broader positive impact.

The importance of financial strength

We believe that in order to generate a long-term positive global impact, companies must:

- Be financially sound

- Be well-managed

- Have strong strategic positioning.

Our investment process puts equal emphasis on financial analysis and impact analysis, because financial strength provides a company with numerous advantages that can directly affect how much impact it can make.

It allows them to invest in research and development and execution capabilities to generate positive, scalable impact through innovative, commercially more viable solutions and broader distribution. In addition, these quality companies can potentially generate strong financial returns over the long-term helping us to meet our dual objective.

Investor contribution

Engaging to create real-world change

Our engagement and voting is focused on creating real-world change. We engage with companies to:

- Help them more effectively make a positive impact on our targeted outcomes

- Encourage them to set targets for their impact and report back on their progress

- Ensure they address any negative impact they may have on any of our targeted outcomes

We set clear goals and expectations for our engagement with companies and continually assess the progress we’re making. Where we’re not seeing companies making progress against our reasons for engaging, we’ll consider what further action we might take.

We also use our voting rights to vote on a company’s proposals at shareholder meetings.

Related documents

Why AXA People & Planet Equity

People & Planet Equity Strategy

Find our more about our People & Planet Equity Strategy by visiting our fund centre.

View fund

Sustainability Disclosure Requirements

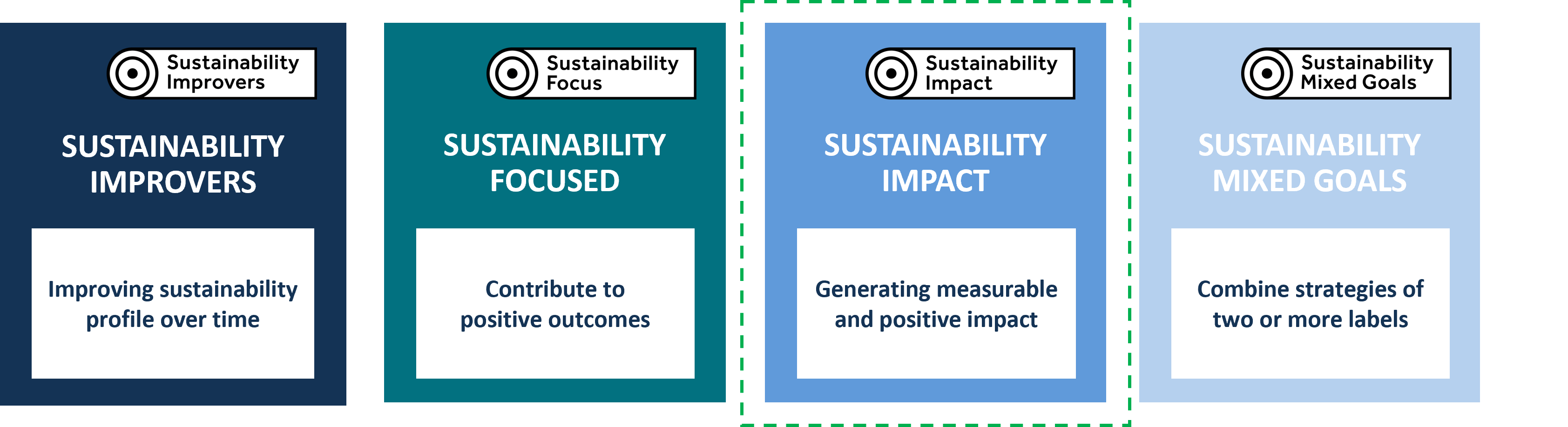

The FCA’s Sustainability Disclosure Requirements (SDR) help investors to find products that match their own sustainability requirements. AXA IM UK has adopted the Sustainability Impact label for the AXA People & Planet Equity Fund.

As part of the SDR regulations, fund managers have to produce a report for all funds that include sustainability or environmental, social and governance (ESG) considerations in their investment approach. For funds that have adopted a sustainability label, this includes data to show how effectively they are achieving their goal.

View the AXA People & Planet Equity Fund SDR report and other key information here

Key risks

For AXA People & Planet Equity

The list below of risk factors is not exhaustive. Please refer to the prospectus for full product details and complete information on the risks.

Counterparty Risk

Failure by any counterparty to a transaction with the fund to meet its obligations.

Emerging Market Risks

Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. As a result, investments in such countries may cause greater fluctuations in the fund’s value than investments in more developed countries.

Currency Risk

The fund holds investments denominated in currencies other than GBP. As a result, exchange rate movements may cause the value of investments (and any income received from them) to fall or rise affecting the fund’s value.

Disclaimer

This marketing communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.