The view from the Core CIO Office - July 2024

- 01 July 2024 (7 min read)

KEY INVESTMENT THEMES

CIO Office: Opinions

Chris Iggo, CIO AXA IM Core

Should we worry about valuations in US credit markets?

Credit markets offer investors attractive potential risk-adjusted returns, underpinned by solid fundamentals. However, in the US, credit spreads are relatively narrow compared to their distribution over the last 10 years. The average investment grade credit spread is around 100 basis points (bp) compared to government bonds and for high yield credit the average spread is 320bp. These sit at the 25th and 50th percentile of the respective 10-year distribution. Since the US regional bank crisis of March 2023, spreads have narrowed by 60bps for investment grade and by 200bp in high yield credit, delivering strong total returns of 6%, and 11% respectively. Given where spreads are now and the more uncertain outlook for Treasury yields, we would expect US investment grade credit returns to be closer to their current yield of 5.0%-5.5%, with risks balanced around that range. High yield credit has more opportunity to deliver around 8% total return over the next 12 months.

Alessandro Tentori, CIO Europe

Monetary policy and market-based neutral rate

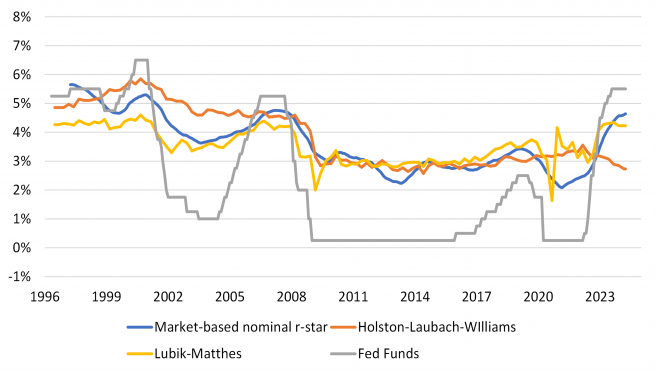

The natural interest rate (aka r-star) cannot be observed. It is the neutral rate of interest, net of inflation, that supports the economy at full employment or maximum output, while keeping inflation constant. Together with monetary policy anticipation, expected inflation and the term premium, r-star defines the level of risk-free bond yields. In addition to model estimates, we can extract useful information from the yield curve. Currently, a market-based measure of r-star stands approximately 150-200bp above pre-COVID-19 levels (see chart).

The high level of uncertainty around r-star automatically translates into uncertainty about the monetary policy stance. What if the natural interest rate was higher than current estimates? What if the long-run dot (r-star) at 2.6% failed to capture the changing structure of the economy? Evidently, the actual monetary policy stance would not be as tight as is widely believed, in which case risk premia across asset classes are probably too compressed to compensate investors for a scenario of repricing of a new interest rate regime.

Furthermore, this high level of uncertainty comes on top of an economic policy mix, which somewhat dilutes central banks’ effort to control inflation. Expansionary fiscal policy, excess liquidity, the inverted yield curve, and risky assets’ valuations (financial conditions more broadly) could imply that the overall policy stance is not as “tight” as generally believed. In this case, implications for GDP growth, inflation and central banks’ reaction are obvious.

Looking ahead, it is likely the current level of the Fed Funds Rate is above most estimates of the r-star and we feel that markets need to be careful about pricing in too many rate cuts. This in turn has implications for expected returns across bond markets and is a strong support for short-duration strategies in fixed income, especially in an environment of inverted yield curves.

Ecaterina Bigos, CIO Asia ex-Japan

Will China equity market performance converge?

Historically, Chinese equities shared a strong directional consistency with developed markets. From Q1 2023, China’s equity market followed a divergent and an underperforming trend, notably, relative to the US.

Reality is that the investment environment has changed, post-pandemic, different paradigms have played out. China reopening “revenge spending” did not materialise, due to negative wealth effects from the property downturn, weak labour market, and comparatively lower savings pools, in absence of significant fiscal support. The US, despite the relentless tightening of financial conditions, was set on a resilient growth trajectory led by an exceptionally strong consumer, supported by a tight labour market and significant post-pandemic savings. Savings buffers have sheltered consumers and corporates alike from higher interest rates, while industrial fiscal catalysts (Inflation Reduction Act, CHIPS Act) have charged fixed investment. Lastly, artificial intelligence excitement has led to a stock market concentrated and interest rate agnostic rally, which has taken three broad forms: the rise in the share of the US equity market in the world, the rise in the share of the technology sector, and the rise in the dominance of the biggest companies in most regions.

In the near term, there is scope for China to trade better, given the strong underperformance, light positioning and supportive policy measures that have started to come through. Medium to long term, structural overhangs of excess leverage and real estate downturn need to be addressed, along with rebalancing towards household demand. China is setting on its own trajectory, with opportunities expected to emerge, but the playbook has changed. With policy makers focusing for now on “industrial upgrade”, signs of strength are those of pick-up in industrial activity and more importantly, ability to successfully channel its output primarily into higher onshore consumption, and into exports. The latter is an externally driven approach, which would necessitate a further increase in its share in world trade.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.