EM Latin America reaction: Mexico keeps policy rate on hold at 11%

- 09 May 2024 (3 min read)

KEY POINTS

First pause in the easing cycle

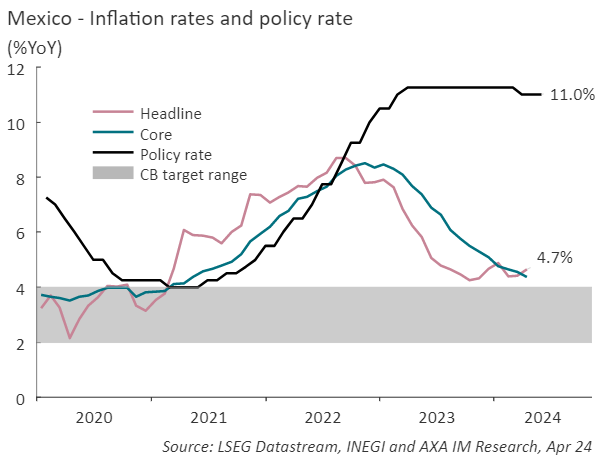

In line with expectations, the Bank of Mexico (Banxico) maintained its policy rate at 11% in a unanimous vote at its May monetary policy meeting. This decision marks the first pause in the easing cycle, as Banxico had suggested might occur, albeit coming at a very early stage. The easing cycle began just one meeting ago in March with a 25-basis point cut. The exchange rate and Mexican local rates remained relatively stable after the decision, indicating that the market had already priced in Banxico’s decision to pause.

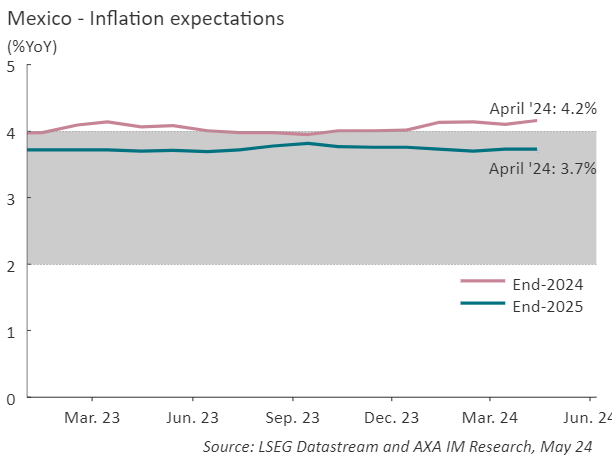

Despite the uptick in headline inflation observed since the last policy meeting (April: 4.7%), Banxico acknowledged in its statement that this increase primarily stemmed from the non-core component. It also noted with approval that core inflation continued its downward trend, reaching 4.4% in April. In this context, the central bank stated its expectation for the ongoing disinflationary process to persist. However, the Board expressed concerns about the stickiness of services inflation, leading to an adjustment in its 2024 inflation forecast. It was revised slightly upwards to 4.0% from the previous 3.9%. Conversely, the 2025 forecast was revised downward by 0.1 percentage points to 3.0%. Additionally, Banxico postponed the timeline for inflation convergence to its 3% target. Now, it expects this convergence to occur in Q4 2025 instead of Q2 2025, as stated at their previous meeting. We envisage a similar trajectory for inflation this year (4.0%) and a higher rate (3.5%) for 2025.

Regarding the Mexican economy, the Board emphasized that the economic softness observed towards the end of 2023 likely persisted into early 2024, despite the labour market's resilience. This outlook aligns with preliminary estimates of Q1 GDP, which showed growth decelerating to 1.6% year-on-year from 2.5% in Q4, the slowest expansion since Q1 2021. We foresee growth continuing to slow throughout the rest of the year due to factors such as high interest rates, a decelerating US economy, and a decrease in remittances in pesos, reflecting the strength of the local currency. Nonetheless, increased public spending ahead of June’s general elections, alongside easing inflation and robust labour market conditions, are expected to provide some support. All things considered, we see growth moderating to 2.2% this year and edging down further to 2.1% in 2025.

Banxico, as in its previous meeting, refrained from offering explicit forward guidance in its policy statement. Instead, it indicated that it will "assess the inflationary outlook to discuss adjustments to the reference rate" in the future. This underscores the bank's commitment to remaining data-dependent. The Board also emphasized that, with this decision, the monetary policy stance remains restrictive. We expect Banxico to resume its easing cycle in June, following an approach of cutting rates at every other meeting. We see the policy rate reaching 10.25% by the end of this year and 7.50% by the close of 2025.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© AXA Investment Managers 2024. All rights reserved